In today’s digital world, having an effective online presence is crucial for businesses in every industry, including insurance agencies. One of the most important elements of an insurance agency’s digital strategy should be creating an effective and targeted landing page.

For insurance agencies, landing pages allow you to connect with prospective customers at the critical point when they are researching and comparing insurance options online. Whether it’s auto, health, home, or other insurance, a tailored landing page can capture leads and drive conversions better than sending people to your main website homepage.

In this article, we’ll explore the ins and outs of creating effective landing pages for insurance agencies. We’ll look at tips and best practices for developing landing pages for different insurance products. We’ll also examine key elements to include and common mistakes to avoid when designing and optimizing your insurance landing pages. With the right strategy, landing pages can become an invaluable part of your digital marketing and lead generation efforts.

A landing page, sometimes called a lead capture page, is a standalone web page that has a singular focus. Unlike a website’s home page which is broader in scope, a landing page is all about one specific offer, product line, or service.

For an insurance agency, a landing page would zero in on one particular insurance product, such as auto insurance, home insurance, or business insurance. The goal of the landing page is to get potential customers interested in that specific insurance product to take a desired action.

The desired action could be requesting a free quote, signing up for a newsletter, downloading an informational guide, or providing contact information. Whatever the call-to-action, the page provides information and messaging focused on getting visitors to convert.

In essence, an insurance landing page is a targeted digital ad for one product line. It allows you to learn more about prospects interested in that specific offering and then further nurture those leads. Having dedicated, tailored landing pages for each insurance product you provide is a smart strategy compared to sending all web traffic to your general website.

Landing pages allow insurance agencies to speak directly to customers interested in a particular policy type. You can customize content, images, offers, and calls-to-action to better convert those specific leads compared to a one-size-fits-all homepage approach.

Having a tailored landing page should be a key part of any insurance agency’s digital presence. But why are dedicated landing pages so valuable? There are three major benefits that landing pages provide:

First, landing pages are excellent for lead generation. A landing page allows you to advertise a specific offering and then direct interested visitors to a page to convert their interest into a solid lead. The page can capture contact details and request information that allows you to continue nurturing the prospect after they leave the page. This provides leads associated with particular products.

Second, landing pages strengthen branding. By creating a page focused on auto insurance, for example, you shape messaging and content around that offering. This helps establish your brand identity and expertise in the mind of customers specifically interested in that type of insurance. People will begin associating your agency with a particular product.

Finally, landing pages provide important data and customer insights. The leads captured provide contact information to nurture. But they also provide valuable data about demand and interest in niche insurance offerings. This informs future decisions around digital marketing campaigns, product development, and other strategy decisions to best serve customers.

In summary, landing pages generate leads, strengthen branding, and provide customer insights. That’s why insurance agencies should leverage targeted landing pages for each product they offer.

One of the most important insurance products for agencies to have a dedicated landing page for is auto insurance. With so many drivers on the road, a tailored landing page focused just on promoting your auto insurance offerings can be highly effective.

When designing an auto insurance landing page, there are a few key tips to keep in mind:

In summary, an effective auto insurance landing page targets drivers through savings, makes quoting smooth, visually relates to consumers, and highlights your expertise. This converts prospective customers into valuable leads.

A health insurance landing page is critical for insurance agencies looking to connect with prospective customers searching for medical coverage options. Here are some tips for creating an effective health insurance landing page:

In summary, a strong health insurance landing page leads with affordable pricing and plan choice details. Relatable imagery, provider info, and benefits covered also help convert interested leads.

Many insurance agencies overlook the importance of having a dedicated landing page for home disability insurance. However, a tailored page targeting this coverage can help capture leads and educate consumers on this often misunderstood policy.

When creating a landing page for home disability insurance, make sure to:

In summary, take an educational approach in explaining this lesser-known insurance product. Affordability, income protection, and an easy quote process are key selling points to promote.

More people are seeking travel insurance as trips resume post-pandemic. Capturing this demand requires a dedicated landing page that speaks to interested travelers ready to protect their vacations.

To create an effective travel insurance landing page:

In summary, focus on how travel insurance gives protection and peace of mind. Make quoting seamless while establishing your expertise in this niche insurance product.

Renters insurance is often overlooked by consumers, making it crucial for insurance agencies to create dedicated landing pages targeting renters.

When making a renters insurance landing page, key tips include:

In summary, make renters insurance approachable and desirable by focusing on affordability, coverage benefits, and ease of getting a quick, competitive quote.

While it takes more time and effort upfront, having a tailored landing page for each insurance product you offer provides major benefits.

Rather than sending all website traffic to one general homepage, creating niche landing pages allows you to:

While it may seem daunting, taking the time to create conversion-focused landing pages for every major insurance type you provide gives your agency a competitive advantage. The investment pays dividends across marketing, conversions, lead quality, and brand positioning.

When designing a landing page for your insurance agency, there are four key elements to include:

First, highlight the benefits and protection provided by the policy. Use bullet points, statistics, and coverage details to summarize what the insurance product delivers for customers. This establishes the value upfront.

Second, feature customer testimonials and case studies. These types of social proof are crucial for insurance landing pages. Quotes from satisfied customers build trust and credibility for a product many people are researching before buying.

Third, make sure to promote available discounts, savings, and special rates. Insurance is often sold based on affordability so it’s important to lead with reduced pricing in headlines and subheaders. Special offers capture attention.

Finally, use strong calls-to-action driving visitors to request a quote or consultation. The goal is to convert interest into a lead. Strategically placed CTA buttons allow visitors an easy path to take the next step.

In summary, conveying the protection provided, building trust through testimonials, touting savings, and making calls-to-action prominent are key elements that set insurance landing pages apart from other types. Focus on these areas to maximize conversions.

Optimizing insurance landing pages takes certain specialized best practices. Here are four key areas to focus on:

First, emphasize social proof elements like testimonials, customer reviews, and trust logos. These build credibility for insurance products people research heavily before purchasing. Quotes and reviews establish trust.

Second, make quoting seamless with calculator tools and rate API integration. Instant, real-time quotes captured on the landing page leads to more conversions. Eliminate friction in the process.

Third, use directional cues like arrows and eye-gazing models to direct attention to your calls-to-action. You want visitors taking clear paths to request a quote or consultation. Strong visual direction improves conversions.

Finally, keep the copy concise with bullet points, headings, and captions to cater to quick skimming. Avoid dense paragraphs. Insurance information should be scannable and easy-to-digest.

In summary, adding social proof, optimizing quoting, using visual cues, and tight writing copy tailored to insurance guides visitors quickly through your landing page for higher conversions. Keep these insurance-specific practices in mind.

When it comes to actually creating tailored landing pages for your insurance agency, there are a few options to consider:

The best approach depends on your budget, timeline, technical skills, and customization needs. For most insurance agencies, landing page builders offer the right balance of speed, flexibility, and affordability. Take advantage of free trials to test options before committing.

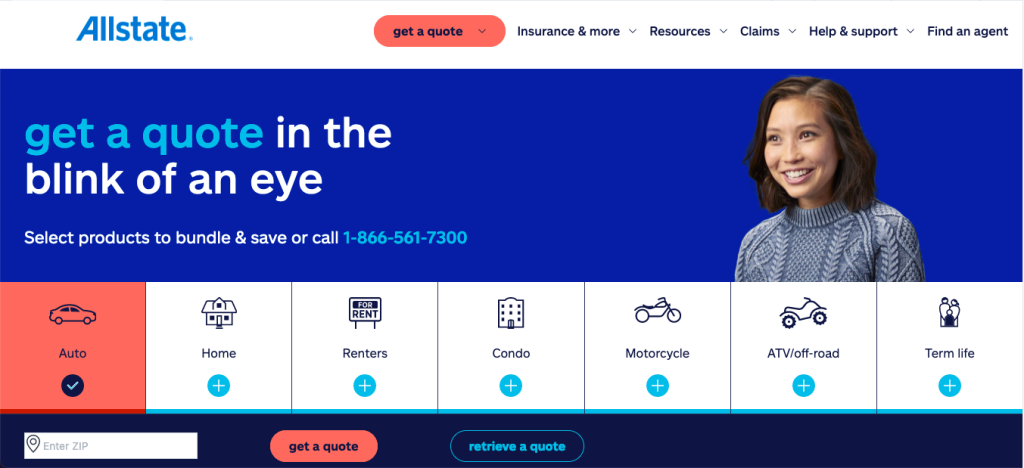

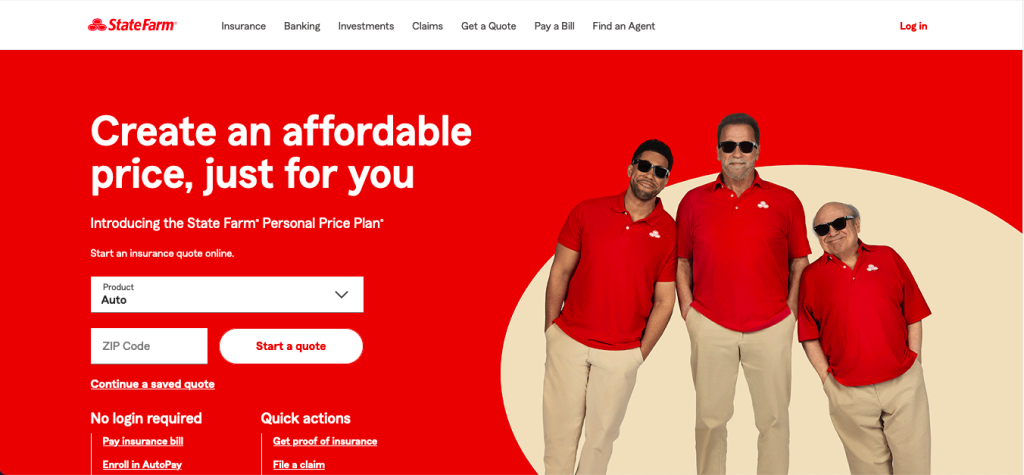

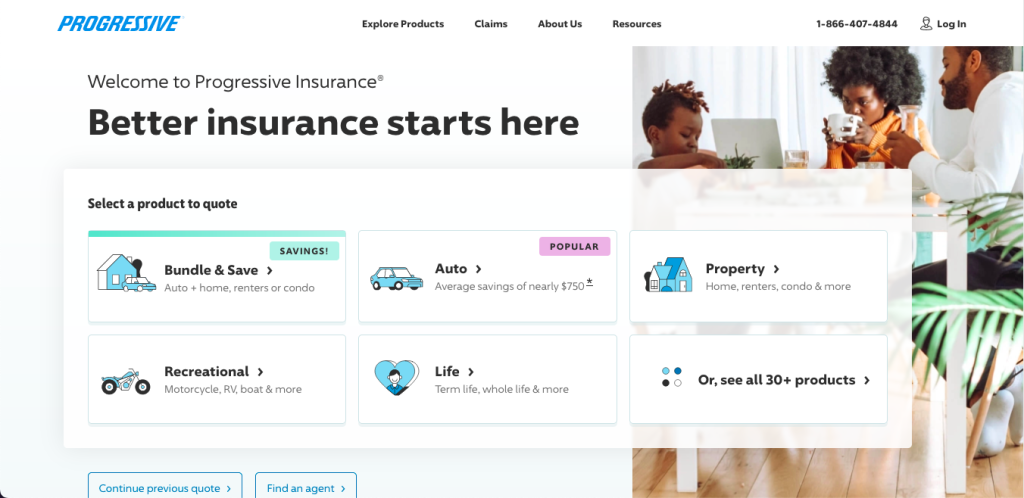

It can be helpful to look at real-world examples of effective insurance agency landing pages for inspiration and ideas. Here are a few strong samples:

These examples demonstrate the power of visuals, clear messaging, credibility building, and calls-to-action. Review competitor examples for ideas you can apply to your own insurance landing pages.

Creating optimized insurance landing pages means steering clear of these common pitfalls:

First, don’t rely solely on generic stock images. Relatable pictures of real customers and situations better connect with viewers. Invest in quality images.

Second, avoid weak value propositions. Clearly state upfront specifically how the insurance protects customers and saves them money compared to being uninsured.

Third, don’t overload pages with text. Use scannable bullet points, bolded headings, and captions to present information. Insurance details should be concise and easy to digest.

Fourth, never lack trust-building elements like customer testimonials, reviews, certifications, and awards. These social proof displays are essential for insurance landing pages.

Finally, refrain from complicated quoting processes. It should be seamless for visitors to get an instant, accurate insurance quote. Minimize form fields for the fastest experience.

In summary, generic images, unclear value messaging, text-heavy copy, no credibility displays, and friction-filled quoting are key mistakes that will tank insurance landing page conversion rates. Avoid them to succeed.

Creating effective, optimized landing pages should be a priority for every insurance agency’s digital marketing strategy. Here are some key takeaways:

Investing in quality landing pages provides insurance agencies with a core asset to reduce advertising costs, grow brand awareness, capture more leads, and drive higher online conversions. Follow best practices and your insurance landing pages will deliver results.

In today’s digital insurance marketplace, your agency’s website can no longer be just an online brochure. To compete and thrive, you need to create tailored landing pages that align with how customers research and shop for insurance online.

Dedicated landing pages allow you to craft focused messaging and experiences that guide each website visitor to convert based on their specific insurance interest. Whether it’s auto coverage, business insurance, health plans, or specialty lines, well-designed landing pages capture leads and build credibility better than sending everyone to a generic homepage.

Creating effective landing pages does require an investment of time and effort. But the payoff in qualified leads, sales growth, and marketing ROI is immense. Following the strategies and best practices outlined in this guide will put your agency on the path to landing page success.

Landing pages allow you to take control of how you acquire, engage, and convert online insurance shoppers. Make them a cornerstone of your digital presence and watch your agency grow.

Where Creativity Meets Simplicity - Customize with Ease! Forget about Coding and Enjoy Designing Your Website.